VAT, company vs. individual

In Audienced, subscriptions are billed in accordance with tax legislation. Below is an explanation of how VAT works, the difference between a company and an individual, and how to correctly enter billing details.

How prices are displayed

- All prices listed on the Audienced pricing page are VAT-exclusive.

- VAT is added at checkout, depending on:

- country,

- user status (company or individual),

- entered tax details.

The final amount including VAT is shown before payment confirmation and on the issued invoice.

Is VAT charged?

Yes.

VAT is charged on all subscriptions.

The VAT rate depends on:

- the country of taxation,

- local legislation,

- the subscriber’s tax status.

Company vs. individual

If you are a company

- enter your company billing details,

- provide a VAT ID if you are VAT-registered,

- VAT is calculated according to applicable regulations (depending on the country).

If you are an individual

- enter your personal billing details,

- VAT is charged at the rate applicable in your country,

- a tax number is not required.

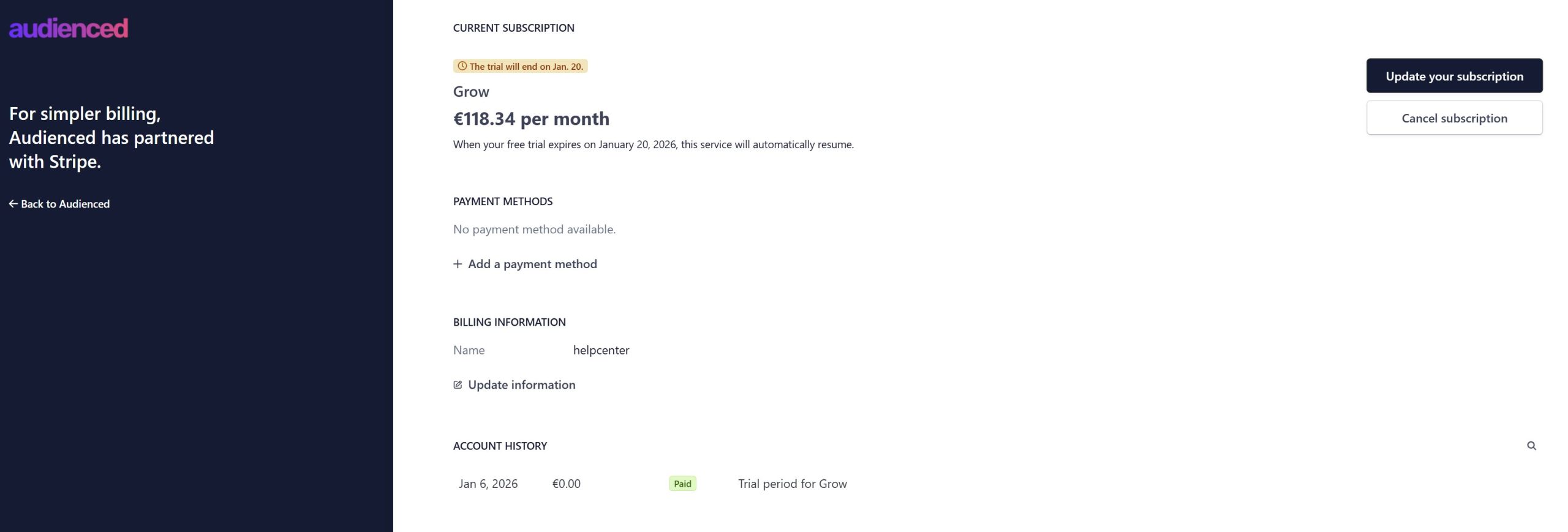

Where to enter tax and billing details

You enter your billing details in:

Subscription → Payment details / Add address

There you enter:

- name or company name,

- email address,

- address,

- phone number,

- tax number (if applicable).

Without this information, the system cannot issue a valid invoice.

Stripe billing

Audienced uses Stripe Billing for subscription billing.

This means:

- VAT is calculated automatically,

- the VAT rate is determined based on the entered details,

- invoices are generated automatically and are available in the dashboard.

Frequently asked questions

Can I remove VAT?

No. VAT is charged in accordance with legislation and cannot be manually disabled.

Why is the final price higher than the price on the pricing page?

Because prices on the pricing page are VAT-exclusive. VAT is added at checkout.

What happens if I do not enter tax details?

The system will display a warning and cannot issue a valid invoice until the details are provided.

Summary

- prices on the pricing page are VAT-exclusive,

- VAT is charged on all subscriptions,

- companies and individuals are billed differently,

- correct billing details are mandatory,

- billing is handled via Stripe Billing.